Agent / Broker Merger & Acquisition Summary

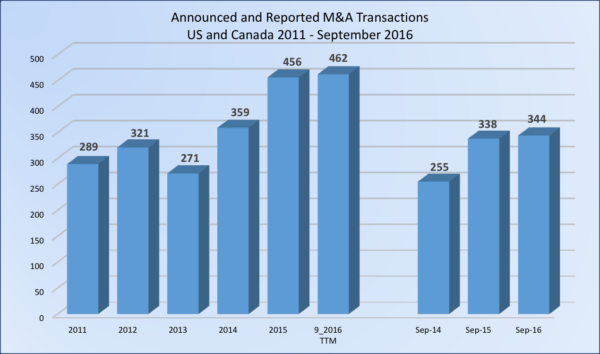

M&A Activity continues to expand through the 3rd Quarter, with reported transactions in the US and Canada up from 338 in 2015 to 344 in 2016, with the Trailing 12-Month (“TTM”) totals now at 461 transactions.

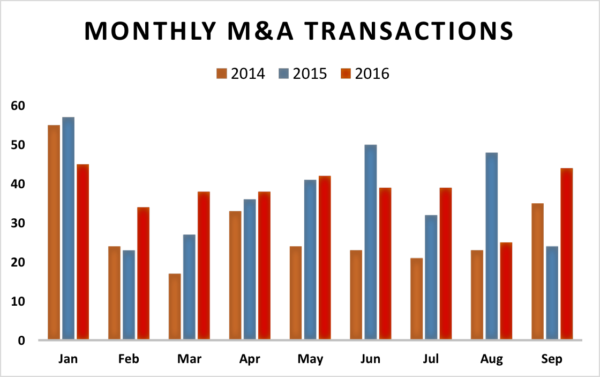

Monthly M&A Transactions

Breaking the data down into monthly activity levels, buying activity took a short summer vacation this year during the month of August but rebounded during the month of September, leaving the total number of acquisition transactions at 108 for the quarter, up from 104 in 2015 and only 79 in 2014.

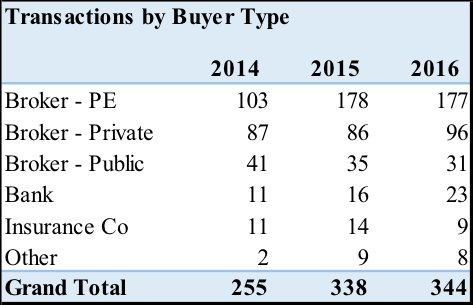

Transactions by Buyer Type

Taking a quick look at the make-up of the transactions for the year compared to 9-month data from the last 2 years:

- The Private-equity backed firms continue to drive the M&A market, again accounting for over 50% of all reported transactions

- A little pick-up in the Privately-owned buyer group and more slippage in the Public broker activity levels in 2016

- Bank activity up almost another 50% from last year

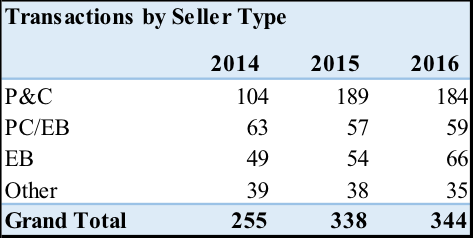

Transactions by Seller Type

- P&C firms continue to be the focus of acquisitions

- Sales of Employee Benefit (“EB”) firms have picked up in 2016, showing growth over 2015 in each quarter

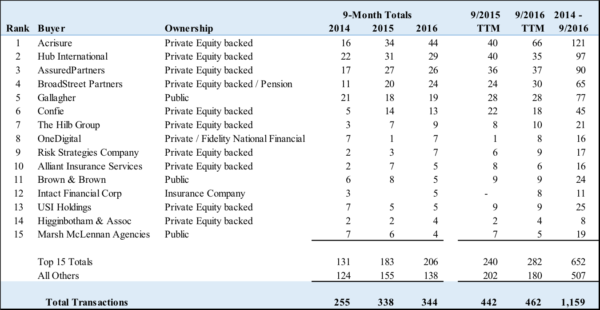

Top 15 Buyers

Looking at the individual buyer activity, we know not all transactions from all buyers are reported, with some of the larger buyer firms only reporting transactions of a certain size whereas other buyers include all acquisitions regardless of size, so the actual number of transactions by firm are not provided on a consistent basis. However, with that said, based on the reported transactions, the most active buyers thus far in 2016 compared to 9-month totals from the past two years, as well as trailing 12-month totals (“TTM”) through September 2016 and cumulative transactions since the beginning of 2014, are shown in the table below.

- Acrisure remains the most active acquirer in 2016, the TTM and since the beginning of 2014, with 50% more transactions than their closest competitor this year alone

- OneDigital (formerly Digital Insurance) has picked up their pace of acquisitions this year, announcing 7 transactions thus far in 2016 compared to only one for the same period in 2015, with four of these transactions in the 3rd Qtr.

- Other than OneDigital (owned by Fidelity National Financial) and publicly traded Gallagher, each of the other Top 10 buyers are owned by private-equity backers. Broadstreet Partners is owned principally by a Canadian pension fund and is treated as a Private-Equity owned buyer.

- The concentration of reported transactions in the Top 15 buyers has increased again in 2016, now reaching 60% of the total compared to 54% and 51% through 9 months of 2015 and 2014, respectively.

Summary:

The M&A marketplace continues to be very active with no end in sight. Interest rates remain low, and money is plentiful for buyers to continue aggressively investing in the insurance broker community. Our cautions and comments to clients and others remain the same:

- Like most other things in the world, this period of insatiable appetites and aggressive pricing won’t last forever. At some point, yet to be determined, investors will demand higher returns which will cause valuations to experience some pull back

- If you are a potential seller, consider acting sooner than later while the irons are hot and the pricing is favorable

- If you are a buyer, make sure you are doing your homework on the potential seller and have fully evaluated their risk and growth potential, and try not to get caught up in the market fervor pricing out there today. One bad deal can cause great harm to a smaller firm if you’re not adequately capitalized.

- If you’re neither buyer nor seller, ignore all the hyperbole and focus on growing your agency and improving your metrics every day. Keep your long-term plans in sight and take the necessary steps to position yourself to achieve your goals.